Accounting for the “Right to Return” given to Customers under Ind AS & IFRS

- Vinay Nahar

- Aug 14, 2023

- 3 min read

Updated: Sep 22, 2023

Many entities (“B2B” and “B2C”) sell their products to customers with a “Right to Return”. The reason can include industry expectations, marketing etc. Ind AS 115 & IFRS 15 – Revenue from Contract with Customers provides the guidance and provisions to account for such rights.

Let us understand the accounting for this right to the customer under Ind AS & IFRS through a case study:

A. Facts of the case:

An entity ABC Ltd is in the pharmaceutical industry. Their customers are the wholesalers in each state. The wholesalers, through the contract, have the right to return the products which are damaged and have expired. The entity’s products have an expiry period of 12 to 24 months. The invoices raised during the FY 2021-22 for INR 600 crores.

B. Query:

The amount of revenue to be recognized in the FY 2021-22 and will the right to return the product have an impact in it.

C. Analysis and Conclusions:

The right to return will be considered a “variable consideration” as per Ind AS 115 & IFRS 15. The entity is to determine the amount of consideration to which the entity expects to be entitled. Any amounts received (or receivable) for which an entity does not expect to be entitled, the entity shall not recognize revenue when it transfers products to customers but shall recognize those amounts received (or receivable) as a refund liability.

The products which we are expected to be returned should be recognized as an asset (at cost as per Ind AS 2 & IAS 2– Inventories) in the books of accounts.

In the given facts of the case, the wholesalers (customers) have the right to return the unsold products which have expired or are damaged. The entity, ABC Ltd is to make an estimate about the number of products they expect to be returned by its customers and not recognize revenue to that extent.

While estimating the number of unsold products which will be returned, the entity should consider its experience of the products returned in the past and present and future conditions and expectation. The estimate should be to an extent which can help comply with the requirement of Ind AS 115 & IFRS 15, that it is highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the return of the expired products is subsequently resolved.

Paragraphs B20 to B27 of Ind AS 115 & IFRS 15 deal with the accounting for the right to return clause in the contract with customers.

D. Accounting:

Invoice raised: 600 Crores.

Estimated products which would be returned – 3% of the sales (i.e., INR 18 Crores)

The value of inventory in this case (the product returned as expired or damaged products) would be nil and thus there will be no impact on the value of inventory and cost of goods sold due to this right to return.

Depending on the subsequent facts of the case either there will be a cash payout to the extent of actual returns (debiting the Refund Liability A/c) or be transferred to revenue to the extent the actual returns are lesser than the estimated.

Additional point to be considered:

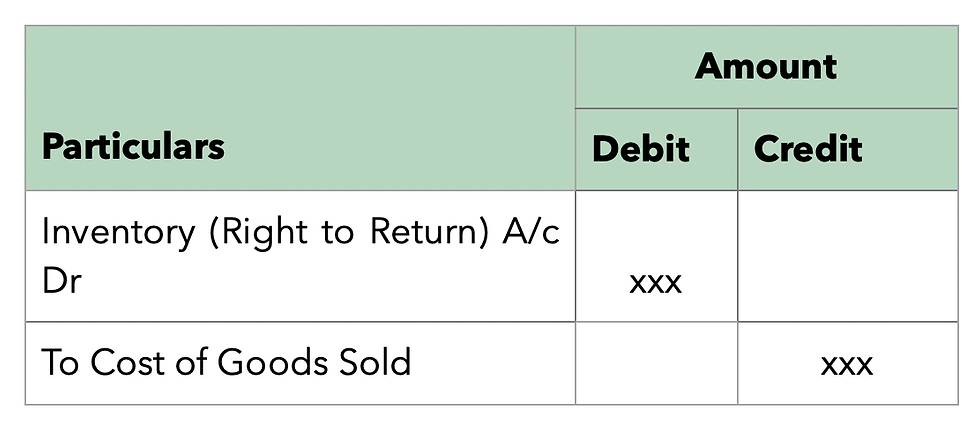

In the case where the customer has the right to return the products even if they are in good condition, there will be an additional accounting entry passed, increasing the value of expected goods to be returned (valued at cost as per Ind AS 2 & IAS 2 – Inventories) and a corresponding decrease in the Cost of Goods Sold.

This article has been published in the Chartered Accountant Study Circle ("CASC") Bulletin.

Comments