Accounting for interest-free or below market rate of interest loans received by entities - Ind AS & IFRS

- Vinay Nahar

- Aug 31, 2023

- 2 min read

Updated: Jan 2

India has become a global hub for manufacturing and is still on a path of growth. Many large and multi-national entities have been setting up business in India and will continue to do so. As part of funding the operations in India, the parent or group entities of these multinationals provide interest-free or below-market rate of interest loans to their Indian subsidiaries.

Let’s understand the accounting (in their stand-alone financial statements) of these interest-free or below-market-rate interest loans taken by an entity through a case study:

A. Facts of the case:

An Entity ABC Ltd is a subsidiary of a parent in the United Kingdom. The parent has provided a loan of INR 5 Crores to the Indian subsidiary ABC Ltd, which is to be repaid after five years and carrying below market rate of interest. If ABC Ltd would have approached an un-related entity (an unrelated bank for example) it would have raised the same amount of money payable after 5 years for an interest rate of 15% per annum (this interest rate would be based on the risk profile of ABC Ltd. and its business)

B. Query:

How the below market rate loans received from the parent would be accounted for in the books of ABC Ltd in the following cases:

(i) 5% interest per annum is charged by the parent.

(ii) The entire loan is interest-free.

C. Analysis and Conclusions:

As per Ind AS 109: Financial Instruments, paragraph 5.1.1 a financial asset or a financial liability should initially be recognised at fair value. In the given scenario ABC Ltd has received a below-market rate of interest loan (either interest-free or at 5%).

This loan taken by ABC Ltd has to be fairly valued at initial recognition. The fair value of the loan would be the present value of the cash outflow as per the terms of the loan discounted at the market rate of interest i.e.,15% per annum in this case.

The difference between the actual amount received and the present value will be treated as an “Equity contribution from the Parent” in this scenario. If the below-market rate of interest loan was given by another unrelated party (other than a government) then this difference would be taken to the Statement of Profit & Loss as gain on the day the loan was received. If a government provides a below-market rate of interest loan, then this difference would be treated as a government grant received and this grant will subsequently be accounted for using the provisions of Ind AS 20: Government Grants.

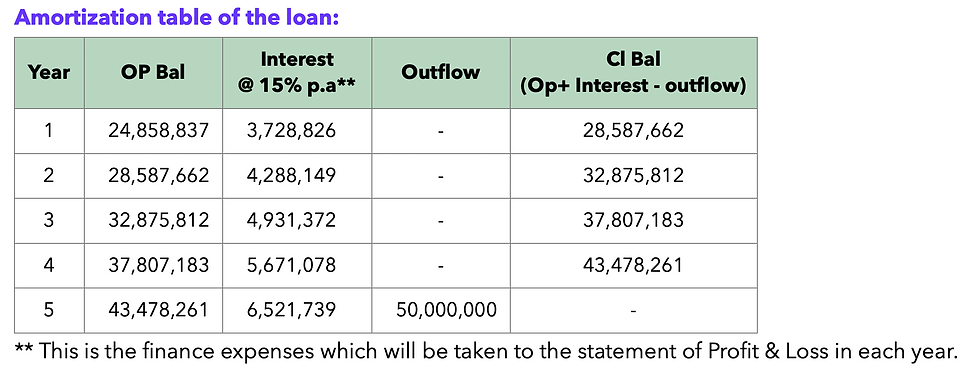

Post the initial recognition this loan will be classified as a financial liability carried at amortized cost and the effective interest rate would be the actual market rate of interest i.e., in this case, 15% per annum.

Query B(i)

Query B(ii)

Reference used for this case study:

Ind AS 109 Para 5.1.1, 5.1.1A, B5.1.1, B5.1.2 & B5.1.2A,

ITFG 18 (7 Feb’19) - Issue 3

This article has been published in the Chartered Accountant Study Circle ("CASC") Bulletin.

Comments